Introduction.

In the maze of healthcare options, understanding your health insurance plan is like deciphering a complicated code. Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Health Maintenance Organizations (HMOs) stand out as the most common types among the numerous options. Although it can be challenging to comprehend these abbreviations, you can learn what they mean and make well-informed decisions regarding your healthcare coverage with a little knowledge.

Health Maintenance Organizations (HMOs):

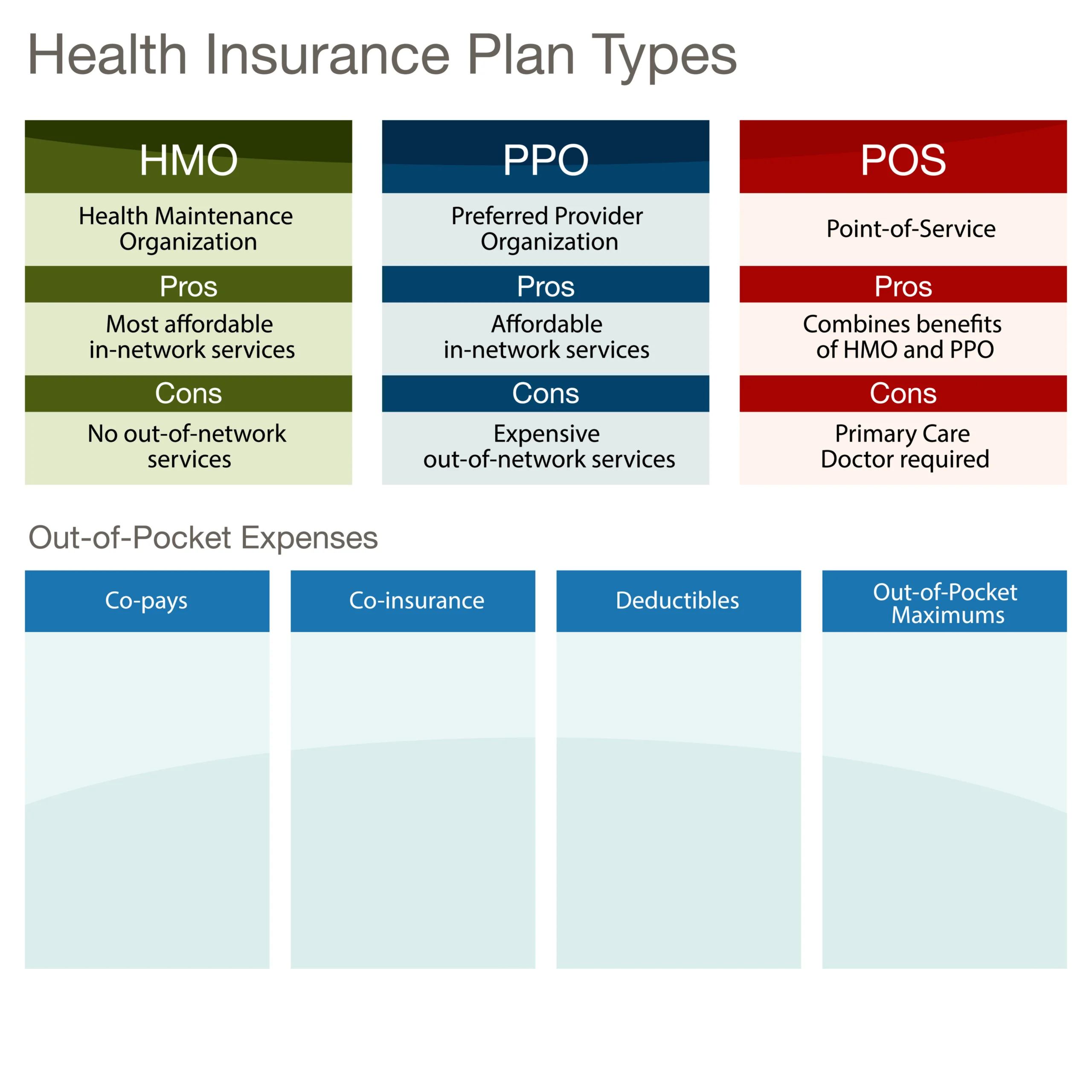

Picture this: Because you just moved to a new city, you need to find a doctor. You can choose from a predetermined network of healthcare providers with an HMO plan—it’s like getting a specific directory. HMOs emphasize cost control and preventative care by requiring you to select a primary care physician (PCP) who acts as your healthcare gatekeeper. This PCP oversees your care and makes necessary referrals to network specialists.

Consistency is an advantage of an HMO. Your premiums are typically lower, and there is typically no deductible. However, a lack of adaptability is a drawback. Getting non-crisis care outside the organization much of the time implies paying for everything. HMOs are best for people who value cost savings, prefer straightforward healthcare, and are willing to give up some provider choice.

Preferred Provider Organizations, or PPOs for short, are:

In the world of health insurance, the PPO is a more adaptable choice. PPO plans offer a wider range of providers than HMO plans. You don’t need a referral to see any specialist or doctor in this location, whether they are in or out of network. However, higher premiums, deductibles, and copayments are a price to pay for this flexibility.

PPOs are a great option for people who value flexibility and ease of use. Do you require specialist care without waiting for a referral? Put it to rest. Do you want to see a specific doctor who doesn’t take insurance? You can yet with higher individual costs. PPOs are beneficial for individuals who are willing to pay a little bit more for the freedom to manage their healthcare without the need for referrals or strict network restrictions.

Exclusive provider organizations, or EPOs, are.

People who want to strike a balance between adaptability and affordability can find a solution in EPOs. They are a hybrid of PPOs and HMOs. Similar to HMOs, EPOs frequently require you to choose a primary care physician; However, unlike PPOs, visits to specialists do not require a referral. But there is one caveat: Insurance can only be purchased for services provided within the network. If you leave the company except during emergencies, it could cost you a lot of money.

People who want to be able to choose their healthcare providers but are willing to stick with a particular network to save money are big fans of EPOs. They frequently have premiums that are typically lower than those of PPOs, despite still providing the convenience of direct access to specialists without the need for referrals.

Choosing a well-thought-out strategy:

So, when faced with the HMO, PPO, and EPO dilemma, how do you select the best plan? Consider your requirements for medical services, financial plans, and individual preferences first.

Investigate your medical procedures: Do you currently suffer from health problems that call for regular visits to a specialist? Do you have confidence in coordinating all of your care with a primary care physician?

Assess the network’s coverage: Take a look at each plan’s provider networks. Does your insurance cover the specialists and doctors you like? How extensive is the organization for travel and crises?

Costs to think about: Look beyond costs. Include out-of-pocket expenses like deductibles and copays. How do these costs stack up against your budget and the amount of healthcare you plan to use?

Think about adaptability: How much discretion do you want to have over who performs your medical procedures? Are you willing to sacrifice some adaptability to possibly save money?

There is no one-size-fits-all solution in the end. The best course of action for you will be determined by your specific circumstances and priorities. Make the effort to investigate various choices, inquire about them, and, if necessary, seek advice from insurance agents. Keep in mind that choosing the right health insurance plan is a significant decision that can have a significant impact on both your health and your financial situation.

You will be able to confidently navigate the healthcare system’s maze of options if you are familiar with HMOs, PPOs, and EPOs. By understanding the complexities of these insurance plans, you can make well-informed decisions that are in line with your health needs and financial goals. So, if you choose one of the three options—an EPO, a PPO, or the more adaptable HMO—you can rest assured that you are working to preserve your peace and health.